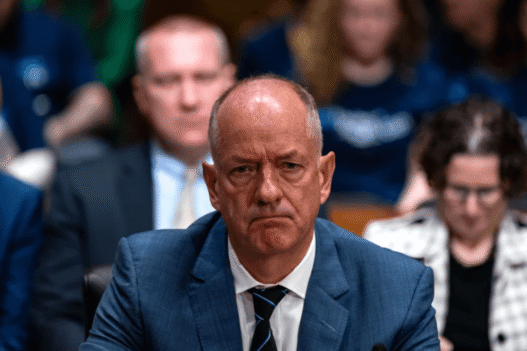

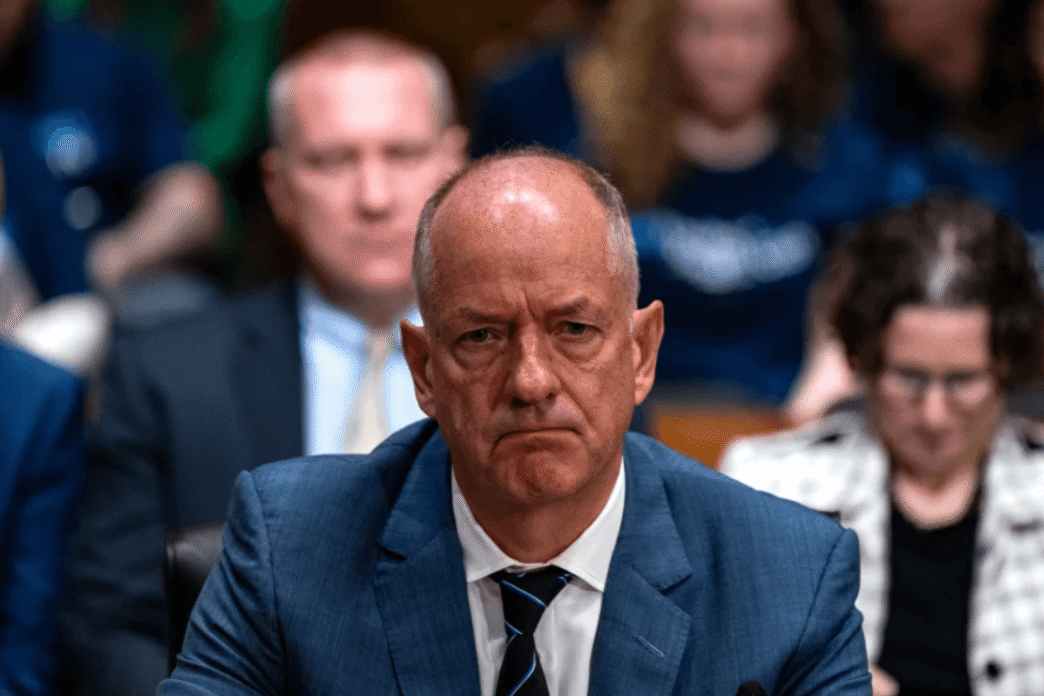

Senator Ted Cruz has introduced a bold financial proposal that would give every newborn in the U.S. $1,000 at birth to invest in the stock market. Dubbed the “Invest America Act,” the plan has now been integrated into the first draft of a sweeping new tax cut package under review by the U.S. House of Representatives.

The initiative would establish private investment accounts for every child, managed by Wall Street firms rather than the U.S. Treasury. The goal, according to Cruz, is to create a generation of financially literate investors who can build wealth early. “Every child in America will have private investment accounts that will compound over their lives, enhancing the prosperity and economic participation of the vast majority of Americans,” Cruz said.

Under the plan, families and friends could contribute up to $5,000 annually to these accounts. Cruz estimates that with 7% annual returns, a child could accumulate around $170,000 by age 18. The funds could be used for higher education, buying a home, or starting a business — all taxed at the capital gains rate.

The proposal is expected to cost the federal government at least $3.6 billion annually, based on current U.S. birth rates. Unlike similar “baby bond” proposals by Democrats like Senator Cory Booker, Cruz’s plan has no income cap, meaning even children from wealthy families would qualify.

Cruz revealed that former President Donald Trump is backing the proposal, now rebranded in the House version as “MAGA Accounts” — short for “Money Account for Growth and Advancement.” The plan is seen as a private-sector alternative to government-run accounts and has strong support from Wall Street, which stands to gain significantly from a large influx of young investors.

While the idea has drawn praise from some as a way to foster financial independence and capitalist values, others are concerned about the cost and its impact on the national debt, now exceeding $36 trillion. Critics also question the fairness of allowing all income levels to participate without limits.

The proposal is still in early stages and will face considerable debate as the broader tax cut plan moves through Congress. Despite the uncertain path ahead, Cruz remains optimistic that the Invest America Act will become a key part of the final legislation.