The smartphone industry is bracing for significant disruptions as new trade policies threaten to dramatically alter pricing structures across major brands. Samsung, one of the world’s leading mobile device manufacturers, finds itself at the center of a brewing storm that could fundamentally reshape the American smartphone market.

Recent policy announcements have sent shockwaves through the technology sector, with implications extending far beyond initial expectations. What began as targeted measures has evolved into comprehensive trade adjustments that could affect millions of consumers and reshape competitive dynamics in the lucrative US smartphone market.

Tariff Details and Scope

The new tariff structure introduces a 25% levy on smartphones manufactured outside the United States and sold domestically. Initially conceived with Apple as the primary target, the policy has expanded to encompass all smartphone manufacturers operating similar production models.

President Trump’s clarification regarding the tariff’s broad application has created uncertainty across the industry. The measure affects virtually every major smartphone brand, including Samsung, which relies heavily on overseas manufacturing facilities to meet global demand.

Industry analysts project that Samsung Galaxy devices could experience price increases ranging from 30% to 40% if the tariffs proceed as planned. This dramatic adjustment would represent one of the most significant pricing shifts in recent smartphone market history.

Korean publication FNNews characterized the situation as an “emergency” for Samsung, highlighting the company’s vulnerability due to its current manufacturing strategy. The report emphasizes how unprepared major manufacturers are for such rapid policy changes.

Manufacturing Challenges

Samsung’s production infrastructure presents unique challenges in responding to the new tariff environment. The company operates primarily through manufacturing facilities located in Vietnam and other Asian countries, with minimal domestic US production capabilities.

This geographic distribution of manufacturing assets, while previously advantageous for cost optimization, now creates significant strategic vulnerabilities. Samsung lacks the infrastructure necessary to rapidly shift production to US-based facilities, leaving the company with limited options for tariff avoidance.

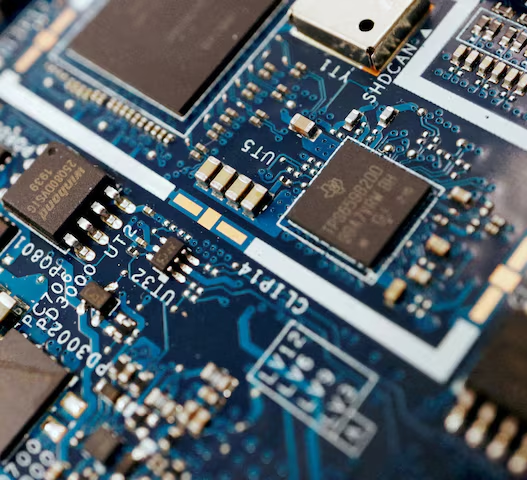

The complexity of modern smartphone manufacturing makes rapid geographic transitions nearly impossible. These devices require sophisticated supply chains, specialized equipment, and trained workforces that cannot be easily replicated or relocated within short timeframes.

Building new manufacturing facilities in the United States would require substantial capital investment and multiple years of development time. Such undertakings involve regulatory approvals, workforce training, and supply chain reorganization that extend far beyond immediate tariff implementation timelines.

Impact on Premium Device Segments

The timing of these tariff announcements creates particular challenges for Samsung’s premium product launches. The Galaxy Z Fold 7 and Galaxy Z Flip 7, representing the company’s flagship foldable technology, are scheduled for release in the coming months.

North America serves as the largest market for Samsung’s high-end foldable devices, making this region crucial for the success of these innovative products. Any significant price increases could severely impact consumer adoption rates and undermine years of research and development investment.

Current estimates suggest the Galaxy Z Fold 7 could see its retail price increase from approximately $1,800 to over $2,500 under a 30% tariff scenario. More aggressive tariff implementations could push prices even higher, potentially placing these devices beyond the reach of many consumers.

The foldable smartphone category represents a key growth area for Samsung, with the company investing heavily in this emerging technology segment. According to market research, foldable devices are expected to become mainstream over the next several years, making current pricing pressures particularly concerning for Samsung’s long-term strategy.

Market Dynamics and Consumer Response

Price elasticity in the smartphone market suggests that significant cost increases could dramatically reduce demand for affected products. Consumers have demonstrated sensitivity to pricing changes, particularly in premium segments where alternatives exist.

The competitive landscape could shift substantially if Samsung’s pricing becomes less competitive relative to domestic alternatives or brands with different manufacturing footprints. This dynamic could benefit companies with more flexible production strategies or existing US-based manufacturing capabilities.

Consumer behavior patterns indicate that smartphone buyers often defer purchases when faced with significant price increases. This tendency could create temporary market disruptions as buyers wait for price stabilization or seek alternative products.

The broader economic implications extend beyond individual purchasing decisions to include impacts on carrier partnerships, retail relationships, and overall market share dynamics within the competitive smartphone ecosystem.

Industry-Wide Implications

Samsung’s situation reflects broader challenges facing the global technology industry as trade policies evolve. Most major technology companies have optimized their operations around international supply chains and manufacturing networks.

The smartphone industry’s global nature means that policy changes in major markets like the United States can create ripple effects throughout international operations. Companies must now factor geopolitical considerations into manufacturing and pricing strategies.

Other manufacturers watching Samsung’s response will likely adjust their own strategies accordingly. The industry may see accelerated efforts to diversify manufacturing locations or develop alternative market approaches to mitigate similar risks.

Uncertainty and Future Outlook

Despite the apparent certainty of the tariff announcements, historical precedent suggests that implementation remains uncertain. Previous rounds of proposed trade measures have faced delays, modifications, or complete reversals due to industry pressure and political considerations.

The June enforcement timeline creates urgency for affected companies, but past experience indicates that actual implementation often differs from initial announcements. Trade policy experts note that complex negotiations frequently occur behind closed doors before final policy implementation.

Samsung has not yet publicly announced its response strategy, likely reflecting the fluid nature of the situation and ongoing assessment of various scenarios. The company’s decision-making process must consider multiple potential outcomes and their respective implications.

For the latest developments on this story and other technology news, visit 1stnews24 for comprehensive coverage of industry developments and their impact on consumers.

Strategic Options and Responses

Samsung faces several potential response strategies, each with distinct advantages and limitations. The company could absorb some tariff costs to maintain competitive pricing, though this approach would significantly impact profit margins on affected products.

Alternative strategies might include accelerating plans for domestic manufacturing facilities, though such initiatives require substantial time and investment. Partnership arrangements with existing US manufacturers could provide shorter-term solutions while longer-term infrastructure develops.

Price differentiation strategies could help Samsung maintain market presence across different consumer segments. The company might focus on cost-optimized models for price-sensitive buyers while maintaining premium positioning for less price-elastic segments.

The situation demonstrates how quickly external factors can disrupt established business models and force rapid strategic adjustments. Samsung’s response will likely influence industry approaches to similar challenges and shape future manufacturing and pricing strategies across the technology sector.