China is reportedly considering relaxing its stringent rare earth export controls for Chinese and European semiconductor companies and their supply chain partners, according to state media reports released Wednesday. This potential policy shift comes as global technology firms face mounting pressure from supply chain disruptions.

The development follows China’s implementation of export licensing requirements in April, which placed seven rare earth materials and related products under strict government oversight. These new regulations mandate that all exporters obtain official licenses before shipping these critical materials abroad, regardless of the destination country or customer nationality.

Current Export Control Challenges

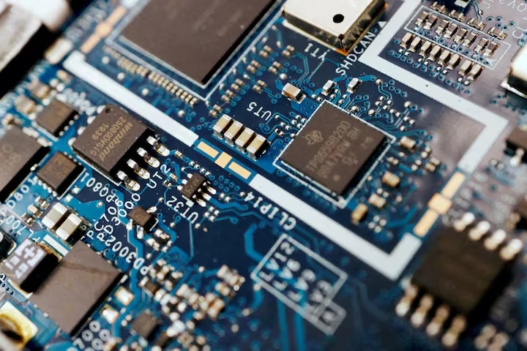

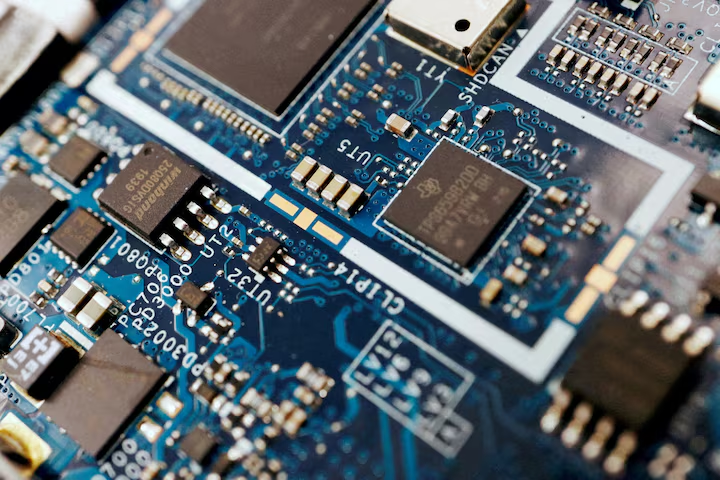

The licensing system has already created significant bottlenecks in the global supply chain. While Chinese authorities have granted a limited number of export licenses for rare earth magnets – essential components used in semiconductor manufacturing, automotive systems, and defense applications – the approval process remains complex and time-consuming.

Industry sources indicate that the licensing procedures can take several months to complete, creating uncertainty and delays at customs checkpoints. This bureaucratic maze has sparked confusion among exporters and importers alike, threatening the stability of international supply chains that depend heavily on Chinese rare earth materials.

High-Level Discussions Address Industry Concerns

The potential policy adjustment emerged from discussions during a crucial meeting between Chinese and European semiconductor companies, hosted by China’s Ministry of Commerce on Tuesday. During this session, Chinese officials provided detailed explanations of the current application process and listened to industry concerns about supply chain disruptions.

According to China Daily’s reporting, government representatives indicated willingness to consider more flexible approaches for qualifying companies within the semiconductor supply chain ecosystem. This suggests that Beijing may be responding to mounting international pressure while maintaining strategic control over these critical materials.

European Industry Voices Urgent Concerns

Jens Esklund, president of the European Union Chamber of Commerce in China, emphasized the critical nature of the situation during the meeting. He highlighted that European Chamber members expressed their urgent need for accelerated approval processes to maintain supply chain stability.

“This is imperative, as many European production lines will come to a halt very soon due to the shortage of crucial inputs,” Esklund explained in his statement. His remarks underscore the immediate threat facing European manufacturers who rely on Chinese rare earth materials for their operations.

The semiconductor industry’s dependence on these materials cannot be overstated. Rare earth elements are essential for producing high-performance magnets, electronic components, and specialized alloys used in cutting-edge technology applications. Any disruption in their supply can cascade through entire manufacturing ecosystems.

Global Supply Chain Implications

China’s dominance in rare earth production gives it significant leverage over global technology supply chains. The country controls approximately 80% of global rare earth processing capacity, making it virtually irreplaceable in the short term for companies requiring these materials.

The export controls represent part of China’s broader strategy to maintain technological competitiveness while protecting domestic industries. However, the restrictions have raised concerns among international partners about supply security and the need for diversified sourcing strategies.

Industry analysts suggest that any relaxation of these controls would provide immediate relief to semiconductor manufacturers facing production bottlenecks. However, the long-term implications of China’s rare earth policy will likely continue shaping global technology supply chains for years to come.

For more updates on international trade developments and technology industry news, visit our homepage for comprehensive coverage.

The situation remains fluid as Chinese officials evaluate feedback from international partners while balancing domestic strategic interests. Companies in the semiconductor supply chain continue monitoring developments closely, hoping for swift resolution to prevent further production disruptions.

External resources for additional context on this developing story include detailed analysis from Reuters and comprehensive trade policy coverage from Financial Times.