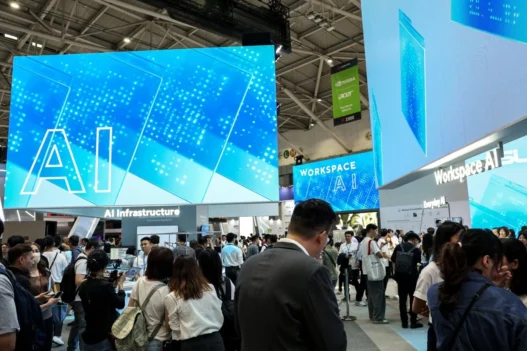

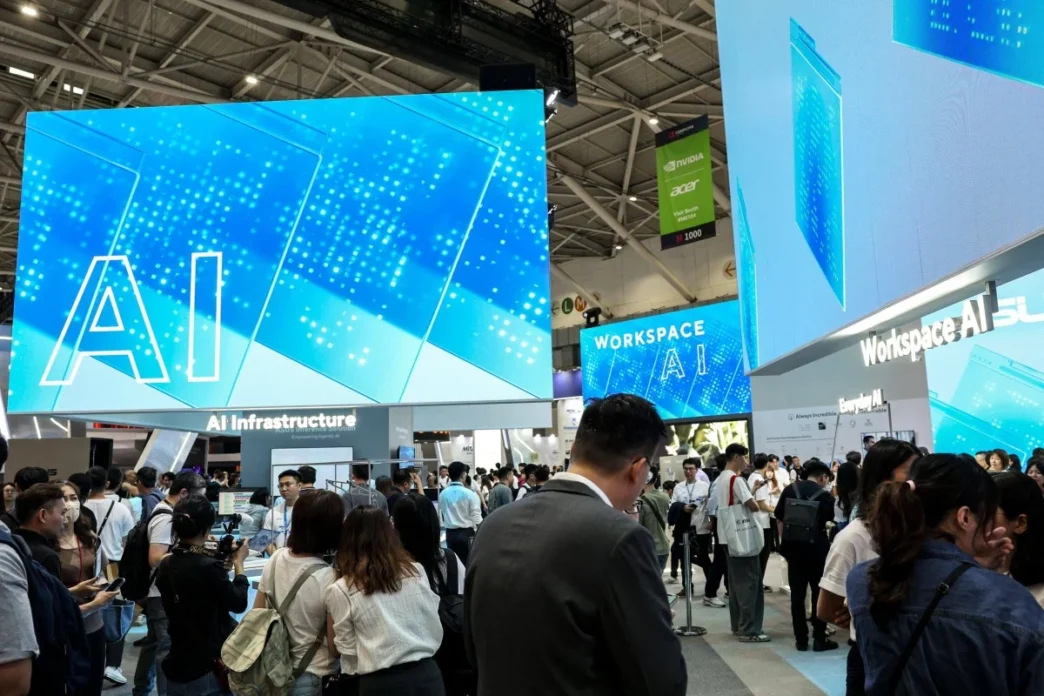

At Computex Taipei 2025, Asia’s biggest technology trade show, the usual buzz of innovation was tinged with anxiety. The vibrant exhibition floors at the Nangang Exhibition Center displayed cutting-edge AI-powered laptops, invisible fiber-optic cables, and AI-enabled peripherals. But a heavy concern hovered over the event: the threat of a renewed US trade war targeting Taiwanese exports.

Despite the impressive turnout of 86,521 attendees and over 1,400 exhibitors, the specter of proposed 32% tariffs on Taiwanese tech exports by US President Donald Trump stole the spotlight behind the scenes. With the US being a primary market, this looming policy shift could impact everything from peripherals and processors to cloud server components.

Exporters Cautiously Optimistic—But Worried

While brands like Nvidia generated excitement with announcements of supercomputing investments in Taiwan, many exhibitors voiced concern about potential tariffs. Some, like Kye Systems—known for its Genius brand of peripherals—have already decided to pause US market expansion.

“For the US, I’m not sure now is the moment—because of Trump,” said Miguel Yeh, a sales representative at Kye Systems. “We have to wait a while.”

Others, such as FiTek Photonics, a long-established fiber-optic cable manufacturer, acknowledged that ongoing tariff negotiations have already begun to raise costs for their global customers. “This is all increasing costs for our customers,” said FiTek’s senior international manager, Cecilia Chao. “Customers still need to fill orders.”

The deadline for reaching a trade resolution is July 9. If a deal isn’t reached, many Taiwanese firms may pull back from the US market, raise prices, or reroute exports through third countries.

Strategies to Stay Afloat

To mitigate risks, some companies are front-loading US-bound shipments ahead of the deadline. Networking device maker Konten Networks, for instance, has tripled deliveries since January to beat the tariff window.

Others, like Sintrones Technology, are shielded by their unique supply chains. Sintrones supplies autonomous driving technology to vehicle makers in Mexico, who then export the finished vehicles to the US—circumventing direct tariffs on Taiwanese components.

Meanwhile, Taiwanese tech companies are increasingly transacting in US dollars and other currencies to avoid losses from the strengthening New Taiwan dollar. Currency volatility is another key concern, especially with Taiwan’s current trade surplus with the US reaching a record $64.9 billion in 2024.

Tariff Fallout: Only the Big Survive?

Industry analysts suggest only the largest firms, such as Taiwan Semiconductor Manufacturing Company (TSMC), can afford the infrastructure investments needed to manufacture in the US. TSMC recently upped its US investment from $65 billion to $165 billion. Other firms like Nanya Technology Corp. are exploring similar possibilities.

Still, small and mid-sized firms at Computex remain vulnerable. Most cannot afford the high costs of shifting operations overseas, let alone navigate the complex logistics of new supply routes.

As of now, talks between the US and Taiwan are “ongoing and proceeding smoothly,” according to Taiwan’s President William Lai. However, the uncertainty is already reshaping business strategies.

For many exhibitors, including those from firms like jjPlus and Konten Networks, the hope is that policymakers will offer a stable resolution. Until then, Computex remains a stage not just for innovation, but for resilience amid geopolitical tension.

Recommended Reading: TechCrunch’s coverage of Computex 2025 for additional insights on emerging technologies at the expo.

For updates on Taiwan’s trade and tech industry, visit 1st News 24, your source for business, technology, and global affairs.