Alibaba Group’s shares tumbled by as much as 4.8% in Hong Kong trading on Monday following reports that its artificial intelligence partnership with Apple has come under US government scrutiny. The drop reflects growing investor concerns about geopolitical tensions potentially derailing a key strategic initiative for the Chinese tech giant.

The sell-off came in response to a detailed report published by The New York Times on Saturday, which revealed that White House officials and congressional lawmakers are investigating Apple’s plans to incorporate Alibaba’s AI technology into iPhones sold in China. According to the report, which cited three anonymous sources familiar with the matter, US authorities are concerned that such a partnership could potentially strengthen a Chinese company’s AI capabilities while deepening Apple’s exposure to China’s censorship and data-sharing regulations.

Geopolitical Tensions and Trade War Context

This scrutiny emerges against the backdrop of ongoing US-China trade tensions that continue to impact global technology companies operating across both markets. Despite recent trade negotiations leading to a temporary 90-day suspension of many reciprocal tariffs beginning in mid-May, the underlying tensions remain significant.

“Under the trade war between US and China, issues such as small parcel tariffs and [Alibaba’s] collaboration with Apple have become sources of concern,” explained Dickie Wong, Hong Kong-based executive director of research at Kingston Securities.

The situation is complicated by the temporary nature of recent trade agreements. According to a May 16 report from S&P Global Ratings, “The recent US-China agreement is only for a 90-day pause. After that period lapses, and absent an agreement, tariffs are likely to go up again, perhaps sharply.”

Impact on Alibaba’s Global Expansion Strategy

This regulatory scrutiny comes at a challenging time for Alibaba, which has identified international expansion as a key growth driver. The company has already faced headwinds from changes to the duty exemption on small parcels that previously allowed it—along with competitors Shein and PDD Holding’s Temu platform—to ship directly to American consumers with minimal customs duties.

For more analysis on the changing landscape of global e-commerce regulations, visit our comprehensive coverage of international trade policy.

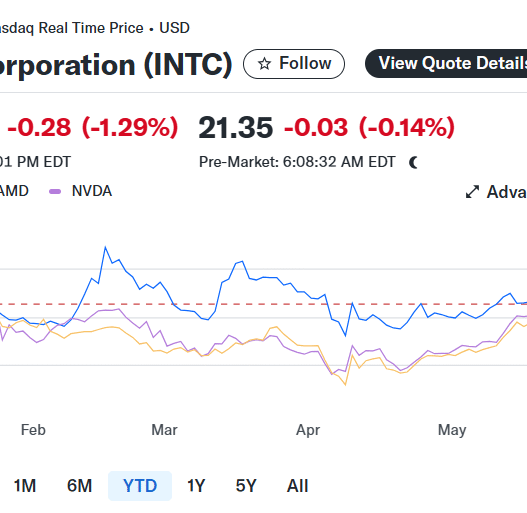

Financial Performance Under Pressure

The timing is particularly problematic as Alibaba recently reported disappointing financial results for the quarter ending March 2025. While total sales rose 7% year-on-year to 236.4 billion yuan ($32.6 billion), and net income surged to 12 billion yuan (a 1,203% increase largely attributed to changes in equity investment valuations), the overall performance fell short of market expectations.

According to Wang Xiaoyan, a Shanghai-based analyst at research firm 86Research, investors were particularly hoping for stronger growth from Alibaba’s cloud computing division, which posted an 18% year-on-year increase to 30.1 billion yuan during the quarter. The expectation was that China’s advances in AI would drive increased demand for Alibaba’s data storage and processing services, making the US scrutiny of its AI capabilities especially concerning for investors.

Future Investment and Profitability Concerns

Analysts also note that Alibaba’s profitability may face additional pressure in coming quarters as the company increases investments in rapid delivery infrastructure. The company has been expanding its “on-demand delivery services,” which promise to deliver online orders within an hour—a capital-intensive offering that requires significant ongoing investment.

“Profit down the road may fluctuate further as Alibaba invests more in on-demand delivery services,” Wang observed, highlighting another area of investor concern beyond the geopolitical tensions.

Apple Partnership Strategic Importance

The potential partnership with Apple represents a significant strategic opportunity for Alibaba in the competitive AI landscape. Apple’s decision to use Alibaba’s AI technology for iPhones in China—the company’s second-largest market by sales—would validate Alibaba’s AI capabilities and provide a prestigious implementation showcase.

However, this partnership now faces uncertainty due to increasing US government concerns about technology transfer and potential national security implications. Neither Alibaba nor Apple responded to requests for comment on the reported investigation.

Market Outlook

As Alibaba navigates these challenges, investors will likely remain cautious about the company’s exposure to geopolitical risks. The stock’s performance reflects growing uncertainty about international expansion plans and the potential limitations on technology partnerships that could arise from increasing regulatory scrutiny.

The situation highlights the complex environment facing multinational technology companies as they attempt to bridge the world’s two largest economies amid persistent tensions and diverging regulatory frameworks.