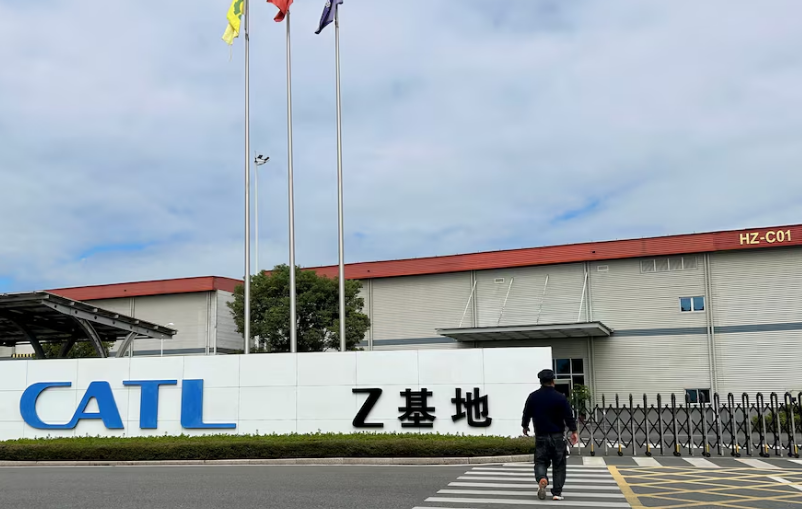

Chinese battery giant CATL has launched its Hong Kong stock offering, aiming to raise at least $4 billion in what stands as the largest global listing so far this year. The electric vehicle battery manufacturer’s move comes amid ongoing US-China trade tensions and ambitious European expansion plans.

Record-Breaking Offering

Contemporary Amperex Technology Co. Limited (CATL), China’s dominant EV battery maker, is selling 117.9 million shares at a maximum offer price of HK$263 per share. This places the initial valuation at HK$31.01 billion ($3.99 billion), according to filings with the Hong Kong Stock Exchange.

The deal size could potentially increase to approximately $5.3 billion if adjustment options are exercised. This surpasses Japan’s JX Advanced Metal’s $3 billion March IPO and represents Hong Kong’s largest listing since Midea Group raised $4.6 billion last year.

Investor confidence appears strong, with CATL’s Shenzhen-listed shares rising 3.6% on Monday to a six-week high after the Hong Kong offering was announced.

Strong Cornerstone Support

More than 20 cornerstone investors, led by Sinopec and Kuwait Investment Authority, have already committed approximately $2.62 billion to the share offering. This robust institutional backing signals confidence in CATL’s growth trajectory despite challenging geopolitical conditions.

The Hong Kong shares are scheduled to be priced between Tuesday and Friday, with final pricing announced by May 19. Trading is expected to commence on May 20.

European Expansion Focus

CATL plans to allocate approximately 90% of the proceeds (HK$27.6 billion) toward constructing its strategically important Hungary factory. This European manufacturing hub will supply batteries to major automakers including BMW, Stellantis, and Volkswagen.

The first phase of the Hungarian facility, representing a €2.7 billion ($3.03 billion) investment, is scheduled to begin production this year. Construction on the second phase is planned to start later in 2025.

“The European expansion represents a critical step in CATL’s global strategy,” said an industry analyst following the company. “Localizing production near European automakers should strengthen CATL’s competitive position while reducing logistical complexities.”

Navigating Geopolitical Challenges

The listing comes during a period of heightened trade tensions between the United States and China. While recent talks in Geneva were described as constructive, substantial tariffs remain in place, with the US imposing 145% duties on certain Chinese goods and China responding with 125% tariffs on select US products.

CATL acknowledged these challenges in its prospectus, stating: “Tariff policies have been rapidly evolving. Currently, we cannot accurately assess the potential impact of such policies on our business, and we will closely monitor the relevant situation.”

Further complicating matters, CATL was placed on a US Defense Department list in January, identifying companies allegedly working with China’s military—a designation CATL disputes as “false” in its prospectus.

Despite these headwinds, the company maintains that the designation “does not restrict us from conducting business with entities other than a small number of US governmental authorities, thus is expected to have no substantial adverse impact on our business.”

US onshore investors are excluded from participating in the Hong Kong offering, though offshore operations of US funds remain eligible.

For more news on global business developments, visit 1st News 24, your trusted source for breaking financial information.