The Federal Reserve is gearing up for its May 2025 policy meeting. This comes amid rising inflation expectations and uncertainty around trade policy. Despite President Trump’s calls to lower interest rates, the Fed is likely to remain steady. It is taking a cautious approach as it reviews new data.

Economic Context and Inflation Concerns

Inflation is a major issue. The Consumer Price Index (CPI) climbed 2.4% year-over-year in March, surpassing the Fed’s 2% target. Long-term inflation expectations are worrisome, now projected at 6.5% for the next year. This increase is mainly due to recent tariffs, including a 145% duty on Chinese imports. These tariffs have raised consumer prices and pressured businesses.

Economic Growth and Labor Market

Despite these inflation challenges, the U.S. economy shows resilience. The job market added 177,000 new positions in April, beating expectations. Consumer spending remains strong, and investor sentiment is generally positive. Many businesses worry about rising costs and supply chain problems caused by trade policies.

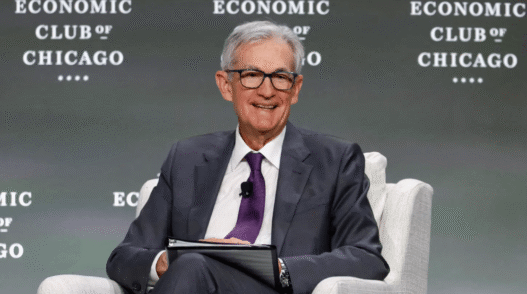

Fed’s Cautious Stance and Future Outlook

Fed Chair Jerome Powell has stated that monetary policy will depend on data. No updated economic forecasts or interest rate projections (the “dot plot”) are set for this meeting. Powell will likely stress the Fed’s wait-and-see approach at his press conference after the meeting. The central bank aims to balance price stability with economic growth.

Market analysts say the Fed might cut rates in 2025 if the economy weakens. Some forecasts suggest two rate cuts by year-end. The Fed is likely to hold off until it sees clear signs of a slowdown in the economy or shifts in inflation trends before it acts.

Conclusion

As the May 2025 meeting nears, the Federal Reserve is in a delicate position. Inflation pressures from tariffs and strong employment figures send mixed signals. For now, the central bank seems ready to keep interest rates steady while monitoring the changing economic landscape. They are ready to act if needed in the coming months.