Hims & Hers Health Inc. (HIMS) recently shared impressive first-quarter results. They surpassed analyst expectations and confirmed their 2025 guidance. However, the company’s stock fell by 5% in after-hours trading. This suggests cautious market sentiment.

In Q1, Hims & Hers grew its subscriber base by 38%. This jump helped drive a 111% year-over-year revenue increase. These numbers show the company’s strong growth in the health and wellness sector. HIMS expects full-year revenue of $2.3 billion to $2.4 billion. This is near the consensus estimate of $2.32 billion. Yet, their second-quarter guidance is less optimistic, which may have caused investor hesitation.

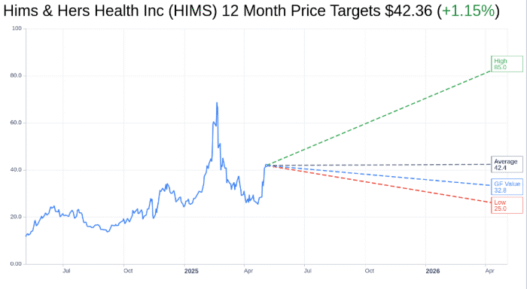

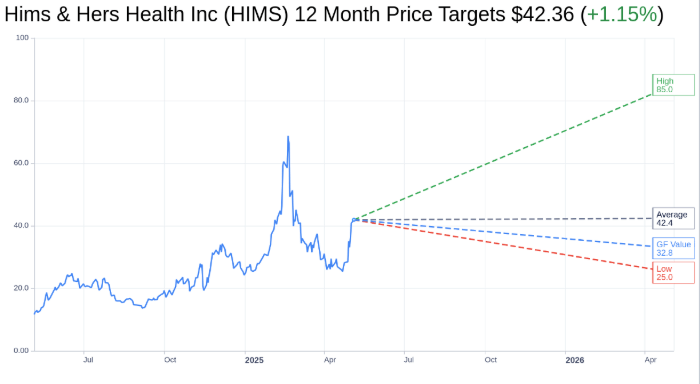

Analysts have mixed views on HIMS. Data from 15 analysts shows an average one-year price target of $42.36. This is slightly above the current trading price of $41.88. Price forecasts vary from $25.00 to $85.00. This shows uncertainty about the stock’s short-term performance.

The average analyst recommendation is 2.9, placing HIMS in the “Hold” category. This means a neutral outlook, with no strong buying or selling expected soon. The rating scale goes from 1 (Strong Buy) to 5 (Sell). Analysts are generally cautious about the company’s valuation despite its strong growth signs.

GuruFocus estimates Hims & Hers Health’s GF Value at $32.78. This suggests a potential downside of 21.73% from the current stock price. This valuation comes from historical multiples, past growth, and future projections. It hints that the stock might be trading above its intrinsic value.

HIMS is doing well with revenue and subscriber growth. But the market’s response has been cautious. This may reflect broader concerns about profitability and near-term growth. For now, investors seem to be waiting to see how things unfold, despite the company’s solid fundamentals.