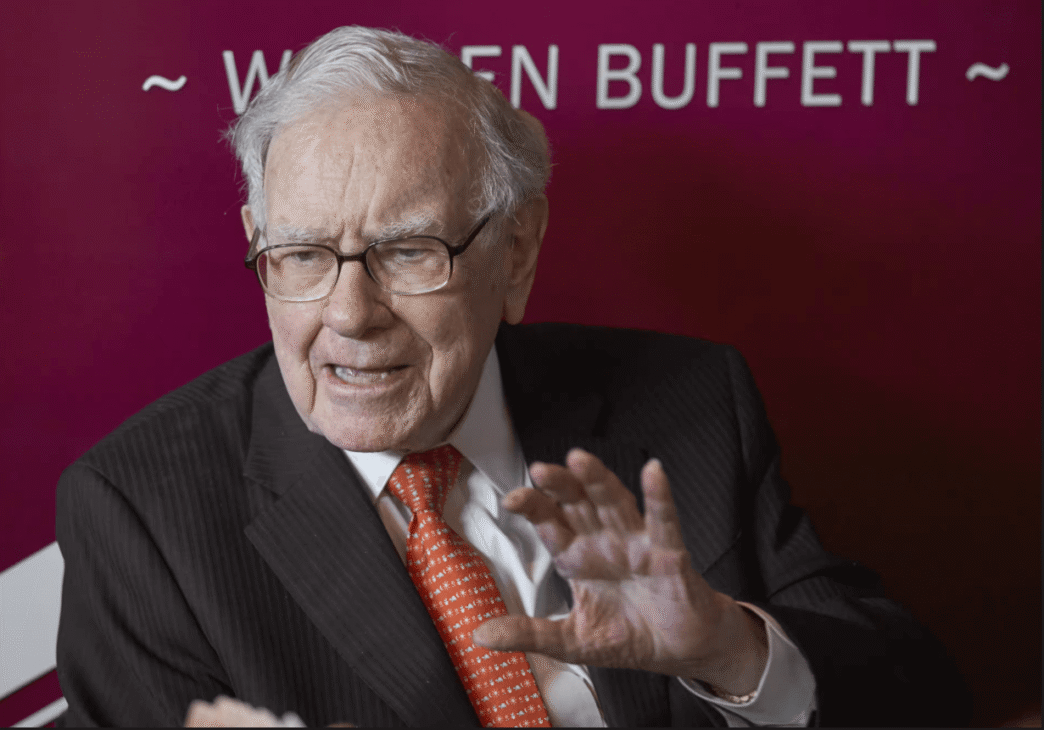

Omaha, Neb.- In a historical and emotional moment at the annual shareholder meeting of Berkshire Hathaway, Warren Buffett, a 94-year-old investor, moved thousands of participants by announcing his retirement as CEO and president by the end of 2025. Group.

The announcement came after a five-hour question-and-answer and answer -session at the Chi Health Center in Omaha, where Buffett, fluttered by Abel, provided news with its signature composition and humility. Packed arena for global investors exploded in a long-time ovation, recognizing the exceptional six-opinion management of Buffett from one of the most prestigious companies in American history.

Buffett told the audience, “I think the time is when Greg will become CEO of the company at the end of the year.”

Buffett insisted that his retirement does not indicate any loss of faith in Berkshire Hathaway’s future. In fact, he said he intends to keep his shares and finally pass them on to his philanthropic plans.

“I have no intentions – zero – Berkshire Hathaway to sell. I will eventually remove it. The decision to hold each stock is a financial decision because Berkshire’s opportunities will be better under the management of Greg.

A Quietly Planned Transition

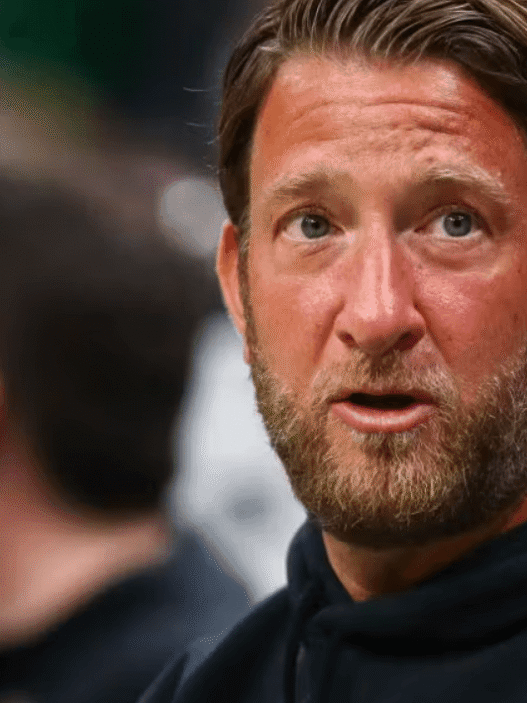

Only Buffett’s youngsters — Howard and Susie Buffett — had prior knowledge of the announcement. Even Greg Abel, who changed into sitting subsequent to Buffett at some stage in the occasion, became taken by means of surprise. Abel, sixty two, stood and joined the applause, visibly moved.

Abel has been Buffett’s formally special successor considering 2001 and has spent 25 years in the organization, coping with its giant non-coverage operations. These consist of utilities, energy, retail, chemical, and actual property belongings, which collectively span masses of billions in annual sales. Born in Alberta, Canada, Abel is widely seen as a ready, level-headed govt in Buffett’s mould.

Despite Buffett’s advanced age and previous tips at succession planning, the timing of his retirement assertion became unexpected, specifically given his repeated assertions that he had “no plans” to step down.

A Legacy of Capitalism — and Controversy

Buffett took control of Berkshire Hathaway in 1965, transforming it from a failing textile firm into a $1.03 trillion powerhouse with holdings in companies like Geico, BNSF Railway, Dairy Queen, Duracell, and Apple. Today, Berkshire owns 189 operating businesses and maintains one of the world’s largest cash reserves.

Under Buffett’s leadership, Berkshire posted a record 27% gain in 2024 operating profits, reaching $47.44 billion, cementing its position as a juggernaut in American capitalism.

Buffett’s career hasn’t been without criticism. Berkshire’s utility unit, PacifiCorp, came under scrutiny after failing to shut off power lines during a windstorm in 2020, contributing to deadly wildfires across Oregon and Northern California. The incident prompted antitrust investigations and lawsuits, denting Buffett’s image as a risk-averse operator.

A Warning on Global Trade

Before dropping his retirement bombshell, Buffett took time to problem a stern warning on U.S. Overseas policy, mainly Donald Trump’s tariffs and their effect on global exchange.

“There’s no question that alternate may be an act of conflict,” Buffett said. “It’s a big mistake for my part when you have 7.5 billion folks who don’t such as you very well, and you’ve 300 million who’re crowing approximately how they have done.”

The billionaire emphasised the significance of world cooperation and interdependence, pronouncing:

“We should be trying to change with the rest of the world. We should do what we do best and they must do what they do excellent.”

Despite his political ties — Buffett has supported Democrats including Barack Obama and Hillary Clinton — he did not endorse Joe Biden in 2020 nor Kamala Harris in 2024, preserving a decrease political profile in current years.

Philanthropy and the Final Chapter

Buffett, currently worth $165.3 billion according to Forbes, has pledged to donate 99.5% of his wealth to a charitable trust overseen by his children. He remains one of the most vocal advocates of wealth redistribution among America’s billionaire class.

As he prepares to step back from corporate leadership, Buffett leaves behind not just a business empire, but a cultural and financial legacy that has shaped the world of investing for generations.

Source Link